indiana estate tax threshold

Here are the mechanics of how you calculate it. What Is the Estate Tax.

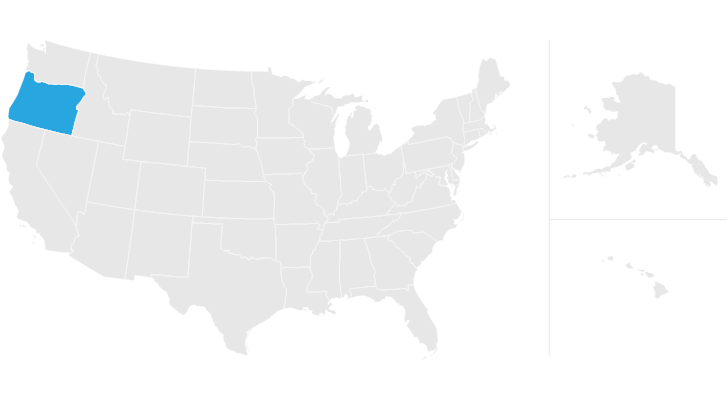

Oregon Estate Tax Everything You Need To Know Smartasset

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am.

. Indiana Estate Tax. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Thankfully there is no inheritance tax in Connecticut.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Indiana Department of Revenue. The threshold varies based on municipality.

This entire sum is taxed at the federal estate tax rate which is currently 40. In 2022 the federal estate tax. How Much Tax Is Due.

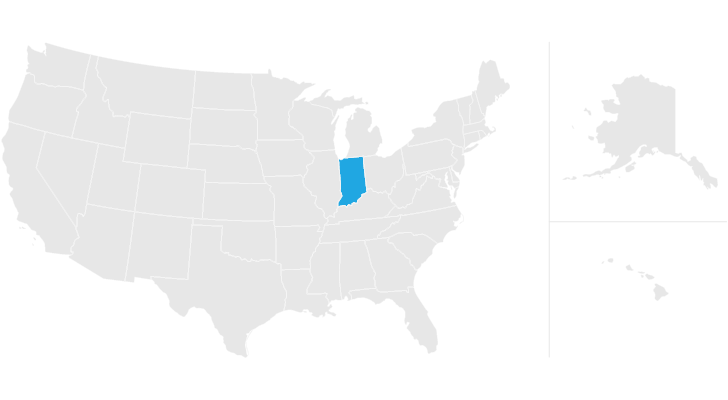

Indiana estate tax threshold Sunday May 22 2022 However the new tax plan increased that exemption to 1118 million. If youre making an estate plan in Indiana start here. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there.

The following assets do not need to go through probate. The federal government gives you an exemption of 117 million for tax year 2021. Since most people have a net worth far below this amount you can see why the estate tax impacts so few people.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. That 40 rate is the top tax rate and it only applies to families leaving behind more than 1 millionafter accounting for the lifetime gift tax exclusion. Indiana Estate Tax Everything You Need To Know Smartasset Up to 25 cash back Indiana Estate Planning.

The estate tax sometimes also called the death tax is a tax thats levied on the transfer of a deceased persons assets. In Indiana if your estate is small or worth less than 50000 you may be able to avoid probate altogether. Valued at more than 1206 million are subject to the federal estate tax on the balance of their value over this threshold as of 2022.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. When the value of an investment in capital assets such as real estate experiences growth and subsequently sold there is a tax on the capital gain at that time.

Details on the Indiana probate and estate tax laws are outline in the table below. 1 Benefits to Using Lifetime Gift Tax Exclusion Early. Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022.

That means the federal government gets to collect 132 million in taxes leaving a total of 1368 million for your heirs. For instance if your taxable estate is 15 million then after the 117 million credit 33 million is taxable. Estate tax is one of two ways an estate may be taxed.

Pick-up tax is tied to federal state death tax credit. The Estate Tax is a tax on your right to transfer property at your death. Does Indiana Have an Inheritance Tax or Estate Tax.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. The estate tax rate is based on the value of the decedents entire taxable estate. They would apply to the tax return filed in 2022.

Starting in 2023 it will be a 12 fixed rate. So any assets below this level are not subject to the estate tax. 265 24 of income over 2650.

Up to 25 cash back They do not owe inheritance tax unless they inherit more than 500. However be sure you remember to file the following. For individuals dying before January 1 2013.

More information can be found in our Inheritance Tax FAQs. Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax is Due on the Transfer Form IH-TA and notices that life insurance proceeds have been paid to an individuals estate are required for those dying after December 31 2012. Only estates with values reaching a certain threshold are taxed.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. For 2019 and beyond the Maryland threshold will equal the federal applicable exclusion amount. 10 of income over 0.

2 The lowest tax rate for those whose estates total just beyond the 1206 million tax rate is 18. Estate Tax Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. Only 100 is exempt from inheritance tax.

Probate Basics Avoiding Probate Estate Tax Laws Indiana Estate Planning Laws. Of household and 2483000 if you are married filing. Take a look at the table below.

There is also a tax called the inheritance tax. 430 pm EST or via our mailing address. This means that if you give one person more than 15000 in a year then you must report the gift to.

Learn how to make a will trust and power of attorney POA that are valid in your state or get more information about estate planning and funeral laws specific to Indiana. The District of Columbia moved in the. For example amounts of at least 40000 but less than 90000 have a tax rate of 08 -- but only if the estate is worth more than 4 million.

For example if you made gifts of assets during your lifetime valued at 4 million and you owned assets valued at 6 million at the time of your death your estate would be subject to federal gift and estate taxes for the combined value of 10 million at a tax rate of 40 percent. If an estate is worth 15 million 36 million is taxed at 40 percent. The federal government has a gift tax though with a yearly exemption of 15000 per recipient.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Indianas inheritance tax still applies. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

Increased the threshold for the Maryland estate tax to 15 million in 2015 2 million in 2016 3 million in 2017 and 4 million in 2018. The estate tax exemption is adjusted for inflation every year. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021.

The federal estate tax exemption for 2022 is 1206 million. Anyone who doesnt fit into Class A or B goes hereincluding for example aunts uncles cousins friends nieces and nephews by marriage and corporations. Up to 25 cash back Indiana Estate Planning.

The tax rate ranges from 116 to 12 for 2022. IN ST 6-41-11-2. Married couples can avoid taxes as long as the estate is valued at under 2412 million.

Trusts and Estate Tax Rates of 2022. Therefore no inheritance tax returns must be filed at this time. From Fisher Investments 40 years managing money and helping thousands of families.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Federal estatetrust income tax. Indiana is one of 38 states in the nation that does not have an estate tax.

Certain assets will simply pass to heirs and beneficiaries upon the death of the owner.

New Single Family Homes Indianapolis In Andover House Front New Homes House Styles

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

The Best Place To Retire Isn T Florida Best Places To Retire Retirement Locations Retirement

New Estate And Gift Tax Laws For 2022 Youtube

How To Avoid Estate Taxes With A Trust

State Estate And Inheritance Taxes

Indiana Inheritance Laws What You Should Know Smartasset

Who Must File Estate Tax Return When Internal Revenue Code Simplified

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where Not To Die In 2022 The Greediest Death Tax States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Investment Banker Resume Example Resume Examples Job Resume Samples Good Resume Examples